Malaysian Code On Corporate Governance 2000

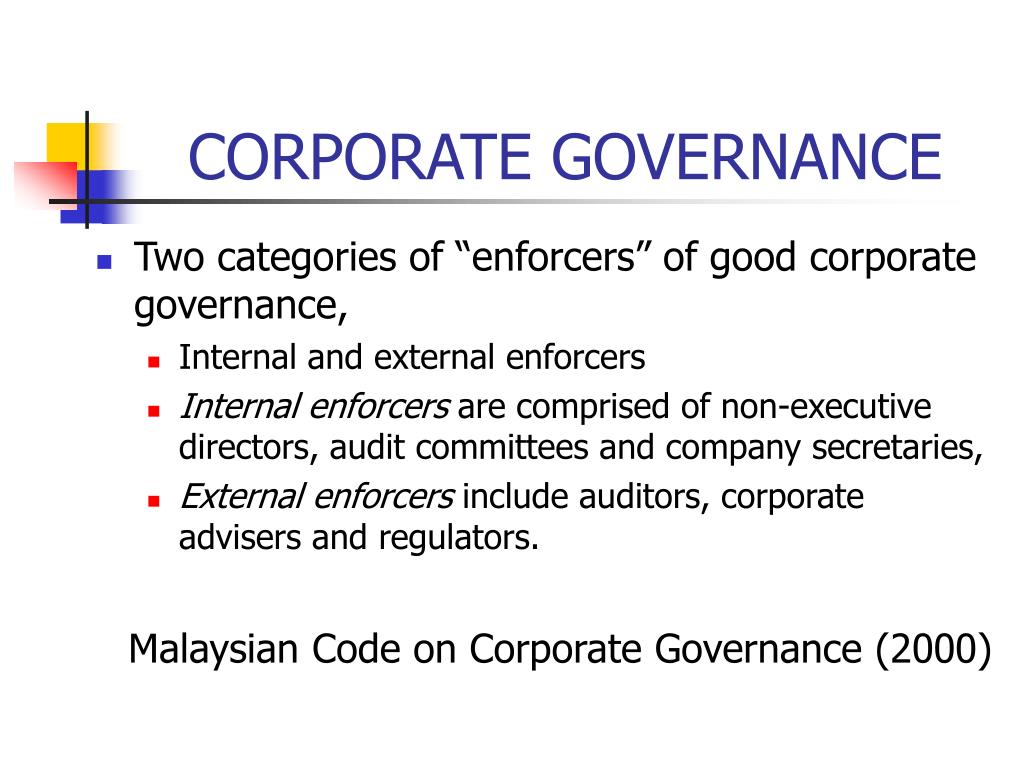

The concept of risk management has been given emphasis since the establishment of malaysian code on corporate governance in 2000.

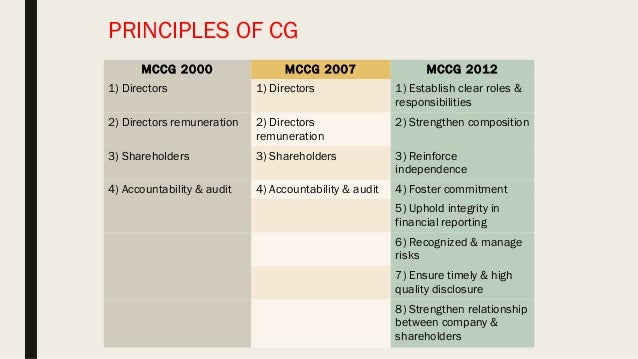

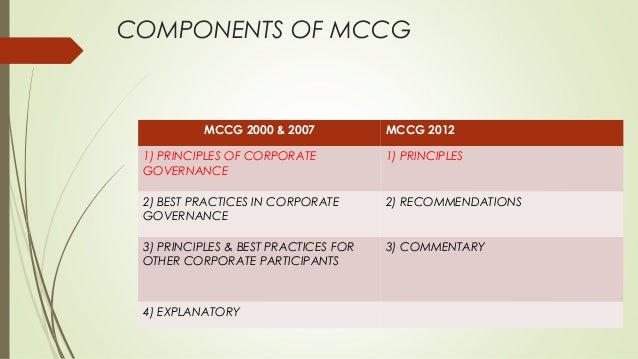

Malaysian code on corporate governance 2000. The code was later revised in 2007 2007 code to strengthen the roles and responsibilities of the board of directors audit committee and the internal audit function. Malaysian code on corporate governance 2000 malaysian code on corporate from management mgt 420 at universiti teknologi mara. The malaysian code on corporate governance mccg introduced in 2000 has been a significant tool for corporate governance reform and has influenced corporate governance practices of companies positively securities commission malaysia 2018. 2 2 the mccg reflects global principles and internationally recognised practices of corporate governance which are above and beyond the.

The model that malaysia adopts is a single tier model which originated from cadbury committee. The corporate governance monitor is an annual publication by the sc on the overall state of play in relation to the adoption of the malaysian code on corporate governance mccg quality of corporate governance disclosures and observations from selected thematic reviews for the year. The malaysian code on corpor ate governance 2000 aims to introduce goo d corporate governance in companies. Malaysia code of corporate governance 2000 malaysia first issued its code of corporate governance in 2000.

2 1 the malaysian code on corporate governance mccg introduced in 2000 has been a significant tool for corporate governance reform and has influenced corporate governance practices of companies positively. It was released by the high level finance committee of corporate governance. The malaysian code on corporate governance code first issued in march 2000 marked a significant milestone in corporate governance reform in malaysia. The guideline was viewed as one of the principal responsibilities of the board of directors ghazali manab 2013 to protect the interest of the shareholders by preserving.